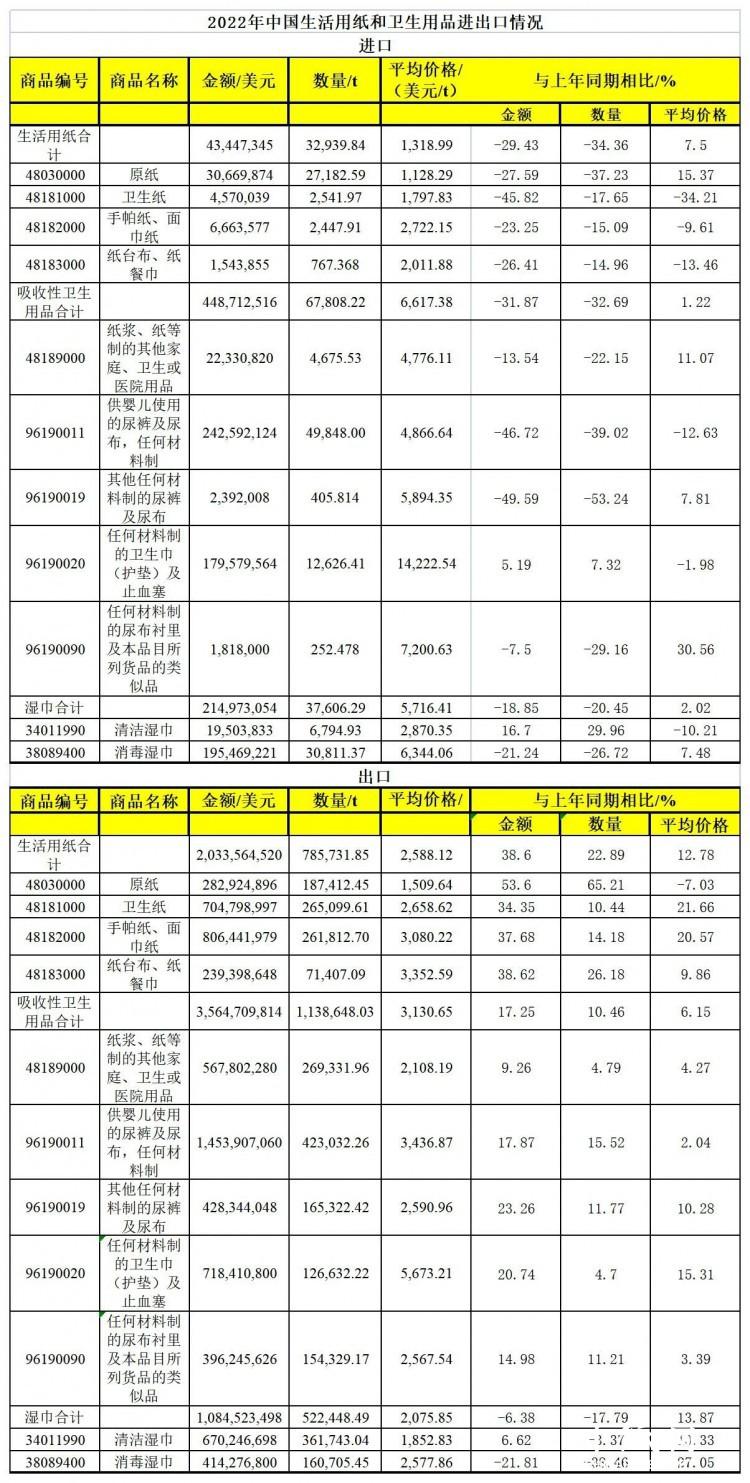

In 2022, the export volume and export volume of household paper increased significantly year-on-year, and the export volume was 785,700 t, up 22.89% year-on year, and the export amount was 2.033 billion US dollars, with a year-on-year growth of 38.6%. Among them, the export volume of base paper saw the largest growth rate, with a year-on-year growth of 65.21%, but the export of household paper was still the finished paper. The export volume of finished paper accounted for 76.15% of the total export volume of household paper products, and the export volume and price of finished paper increased, and the average export price of toilet paper, handkerchief paper and tissue paper increased by more than 20%. The average price increase of export finished products is an important factor driving the growth of the overall export volume of household paper in 2022.

China's import and export of household paper and sanitary products in 2022

Source: Household Paper Committee

1. Household paper

● export

In 2022, the export volume and export volume of household paper increased significantly year-on-year, and the export volume was 785,700 t, up 22.89% year-on year, and the export amount was 2.033 billion US dollars, with a year-on-year growth of 38.6%. Among them, the export volume of base paper saw the largest growth rate, with a year-on-year growth of 65.21%, but the export of household paper was still the finished paper. The export volume of finished paper accounted for 76.15% of the total export volume of household paper products, and the export volume and price of finished paper increased, and the average export price of toilet paper, handkerchief paper and tissue paper increased by more than 20%. The average price increase of export finished products is an important factor driving the growth of the overall export volume of household paper in 2022.

From the perspective of export volume, in 2022, the export volume of finished paper accounted for 86.09% of the total export, and among the export finished products, toilet paper accounted for 34.66% of the total export, accounting for a downward trend year by year (40.84% in the same period in 2020 and 35.75% in the same period in 2021). handkerchief paper and face towel accounted for 39.66% of the total export, accounting for the largest proportion among all the export categories of household paper.

The export of household paper product structure continues to develop to the high-end.

● enter port

At present, the production and product types of the domestic household paper market have been able to meet the demand of the domestic market. From the point of view of import and export trade, the domestic household paper market is generally dominated by export. According to the customs statistics, in recent years, the annual import volume of household paper is basically maintained at 28,000 ~50,000 t, generally less, so the impact on the domestic market is small.

In 2022, the import volume and import volume of household paper decreased year-on-year, and the import volume was about 33,000 t, about 17,000 t less than that in 2021. Imported household paper is mainly base paper, accounting for 82.52%.

2. Absorptive hygiene products

● export

The export scale of absorptive sanitary products has increased steadily. In 2022, the export volume reached 1,138,600 t, with a year-on-year growth of 10.46%. The total export volume of absorptive sanitary products is much higher than the import volume, demonstrating the increasing production strength of China's absorptive sanitary products industry.

Among the largest export products are baby diapers, accounting for 37.15% of the total export, with the highest growth rate of 15.52%, indicating that the competitiveness of Chinese baby diaper products in overseas markets continues to improve.

● enter port

The total import of absorptive sanitary products is decreasing year by year, and the impact on the industry continues to decline. In 2022, imports have fallen from 255,000 t in 2017 to 67,800 t. Among them, baby diapers are still the main proportion, accounting for 73.51%, and their decline was also large, reaching 39.02%. Reasons for the decrease: In recent years, the production capacity and quality of baby diapers in China have increased and improved, while the baby birth rate has decreased and the target consumer group has decreased, further reducing the demand for imported products.

The import of sanitary napkins has been stable for many years, but slightly increased.

3. Wet wipes

In 2022, the import and export volume of Chinese wet wipes decreased significantly, but the export volume was much higher than the import volume. Due to the demand growth caused by the epidemic has gradually returned to normal, China's wet towel production capacity not only meets the demand of the domestic market, but also is highly competitive in the international market.

● export

In 2022, the total export volume of wet wipes was 522,400 t, down 17.79% from the same period last year. The export products were mainly clean wet wipes, and the export volume accounted for 69.24%. The average export price of wet wipes is far lower than the average import price, indicating that China's high-value products such as functional wet wipes still have room to expand in overseas markets.

● enter port

In 2022, the total import of wet wipes was 37,600 t, which has little impact on the domestic market. Among them, disinfectant wet wipes were mainly used, and the import volume accounted for 81.9%. Therefore, the decline of 26.72% of disinfection wet wipes made the import of the whole wet wipes category decline.

Note: At present, cleaning wipes are 34011990 and disinfection wipes are 38089400 in customs commodity codes, but these two codes are not only wipes products, but also other cleaning and disinfection products.

Take advantage of our unrivaled knowledge and experience, we offer you the best customization service.

Get in touch

OEM custom solutions, we have focused on tissue production for 14 years