Paper Pulp Study (II)

Pulp trade channels and related content

Original Blanche investment and research

Research on paper pulp connection (I)

3. Distribution and supply of domestic pulp production capacity

In China, waste paper pulp accounts for the majority, accounting for about 50% of the total supply, followed by self-produced wood pulp (broad-leaved wood pulp and chemical machine pulp for half) and imported wood pulp, a small amount of non-wood pulp. Among them, coniferous pulp is all imported, 60% of the supply of broad-leaved pulp is imported, and the remaining 40% of self-production is mainly for self-use. In 2022, the production capacity of wood pulp is 18.08 million tons, the output is 13.64 million tons, and the import dependence is declining. In 2022, China's total pulp production was 85.87 million tons, including 13.64 million tons of wood pulp, 64.3 million tons of waste paper pulp and 5.58 million tons of non-wood pulp. The production capacity is mainly distributed in Shandong and Guangxi, among which Shandong is the province with the highest wood pulp capacity in China. There are 12 domestic wood pulp enterprises with a capacity of more than 300,000 tons / year, accounting for 85% of the national wood pulp capacity, with a high concentration.

Seasonally, the seasonal supply of pulp is strong, and the shipping volume is seasonal. At the end of each quarter is the peak of pulp shipping volume. At the same time, it should also take into account the impact of the shipping capacity in Nordic winter and the disturbance caused by the production of European winter electricity demand in production. This contradiction may lead to a narrowing of the gap between domestic and European paddle prices. In terms of self-produced wood pulp, every summer is the seasonal low season of wood chips, coupled with the impact of the policy of returning forest and farming, which has a certain impact on the price of wood chips. At present, the purchase price of wood chips excluding tax is 1200-1300 yuan / ton.

In factory production, there is a mode of determining production by sales.

四、 Pulp trade channels and related content

Pulp is divided into self-use pulp and commercial pulp. In 2020, the global trade pulp is about 63.8 million tons, accounting for about 1 / 3 of the total output of pulp, among which sulfate bleached chemical wood pulp accounts for about 30% (12% of drift needle commercial pulp and 17% of floating commercial pulp).

In terms of the flow of pulp trade, the main importing countries of pulp are China, the United States, Germany, Italy, South Korea, the Netherlands, France, among which China accounts for 35%. The main export countries of the pulp are Brazil, Canada, the United States, Chile and Indonesia. In Finland and others, Brazil and Canada account for nearly 40%. China is the largest importer of pulp, Brazil is the largest exporter of pulp, Canada and the United States are the main exporters of drift needle pulp, Brazil is the main exporter of drift pulp, mainly flowing to Asia and Europe, so the inventory data of Europe and domestic ports reflect the inventory situation of consumption places.

Mainstream paper enterprises generally sign long-term agreements with overseas pulp factories to ensure the stability of raw materials. Meanwhile, the routine inventory of raw materials is about one month, and the inventory in transit is about one month. In terms of purchasing brands, paper enterprises will also consider the problem of the lowest cost, and the high substitution between pulp. According to the research results of CITIC Construction Investment, logistics transportation is also a factor of brand selection. For Pacific and Fenbao, the freight cost from the port to the factory is about 100 yuan / ton. However, Russian needle, Wubu and other brands are directly transported through the China-Europe freight train, and enjoy the preferential policy of "Belt and Road", and the price of enterprises receiving goods directly includes the freight.

Paper downstream dealers account for the majority, because of the high cost of maintenance terminals. A small amount of direct supply.

5. Cost analysis of paper pulp

Production cost: pulp pulp process take floating needle pulp as an example, select wood chips with chemical auxiliary [sodium hydroxide (NaOH) and sodium sulfide (Na2S) solution] cooking to form coarse pulp, through the washing machine, screening machine to get fine pulp, make wet pulp board and finally packaged through slices to obtain the pulp package. The pulping cost mainly includes wood chips, accessories (chemicals), energy power and fixed cost, etc. According to the data in the company announcement in Suzano2023, the cost of wood accounted for 42%, accessories accounted for 23%, fixed cost accounted for 20%, energy power 13%, other 3%.

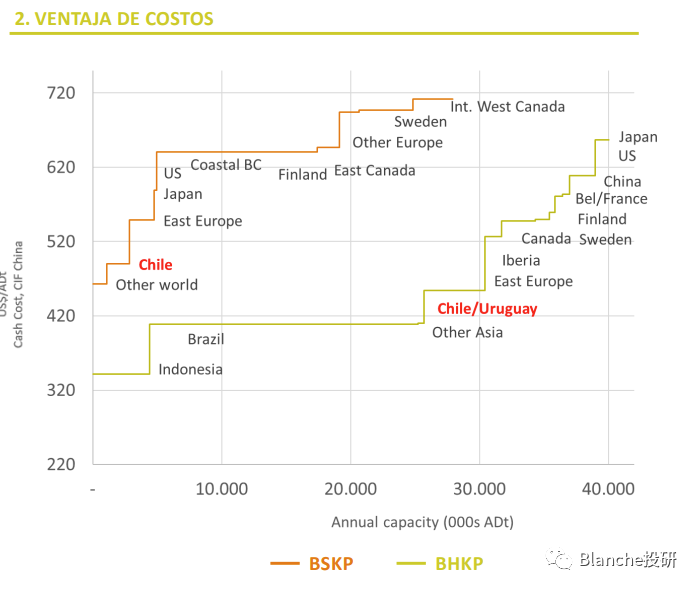

Overseas pulp production costs (the following costs include the CIF price for shipping to China):

Coniferous pulp cost: the chemical and labor costs in Northern Europe and North America are high, so the cost of needle pulp per ton in the United States and Western Europe can be above $600 US dollars, with the highest cost in Eastern Europe and Chile, and the cost of needle pulp is relatively low at around 400-500 US dollars. Chile Arauco2023 Q2 reported separate revenue of $586.8 million, EBITDA one hundred million, four hundred thousand dollars, Because the full product segmentation cost share also includes the cost of wood, Hard to split up, There are both needles and hardwood products, It's also hard to break it apart, So a direct revenue-EBITDA that calculates a production cost and SG & A cost of $486.4 million, 2023Q2 output of 813,000 tons of pulp calculation, The average cost per tonne was $598, The cost must be inflated, But it is estimated that the cost is also around 500, Then rummaged for their 2022 annual report, Find a statistic of global cost, This one is quite complete:

Data source: Hawkins Wright,

Note: other world includes BSKP needle leaf pulp and BHKP hardwood leaf pulp in Argentina, China and Oceania

·

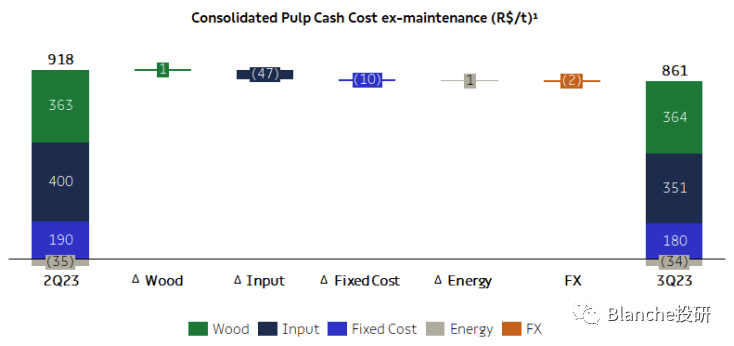

Cost: the lowest price of wood chips in Brazil, At the same time, due to being close to the port and having low labor costs, Brazil has the world's lowest cost to manufacture broad-leaf pulp, After the release of the third quarter of 2023, pulp cash cost (See below) excluding downtime is 861 real, While downtimes effect is 74 Renals, Total of 935 Renals, Overall cost reduction has benefited from the difference between natural gas and chlorine dioxide, Of course, the price does not include the freight yet. Finland's UPM's 2022 annual report disclosed the new Uruguayan pulp plant cash cost level per tonne round 280 dollars (which is the cost of freight, shipped to Shanghai).

·

Data source: Suzano Company announcement

·

Domestic wood chip pulp production cost: the production of a ton of chemical machine pulp needs about 1.1-1.2 tons of absolutely dry wood chips, The production of 1 ton of chemical slurry requires about 2 tons of wood chips, In addition, 900-1100 KWH / ton (5-8 cents for electricity, 70 cents here), Steam 0.1-0.2 tons (currently 190 yuan / ton), Add in about 15%, These non-raw material costs are said to be 1,500, There are surveys in 1700-1800, We take the middle value and calculate it as 1700, According to the recent price of wood chips, the current cost of one ton of chemical pulp is 4,400 yuan / ton (pure estimation), If there are enterprises, the cost of using electricity will be even lower.

·

·

Import wood production pulp cost (this paragraph such as infringement): using citic construction futures calculation method, can delivery needle pulp material from Canada, wood average price of 1495 yuan / ton this year, according to the proportion of the chemical pulp 2:1, raw material cost 2990 yuan / ton, raw materials accounted for 68% -78% of pulp cost, corresponding pulp cost 3833-4297 yuan / ton, give certain industry profit 5%, rate 13% estimate, the price should be in 4522-5070 yuan / ton. This is a good look, but it does give a good way to calculate.

·

·

Import pulp cost: according to the international needle pulp prices, silver star 780 dollars / ton, male lion 750 dollars / ton, gold lion 800 dollars / ton, according to the exchange rate 7, VAT 13%, port miscellaneous fees according to 80 yuan / ton (port miscellaneous fees generally in 50~80 yuan / ton), the import cost of the three brands are 6250,6012 and 6408 yuan / ton, according to the current spot price of 6100 / 6125 / 6225, the basic import no profit.

·

Take advantage of our unrivaled knowledge and experience, we offer you the best customization service.

Get in touch

OEM custom solutions, we have focused on tissue production for 14 years